Rapidly rising production costs is being blamed for the sharp drop in agriculture producers’ perception of current economic conditions.

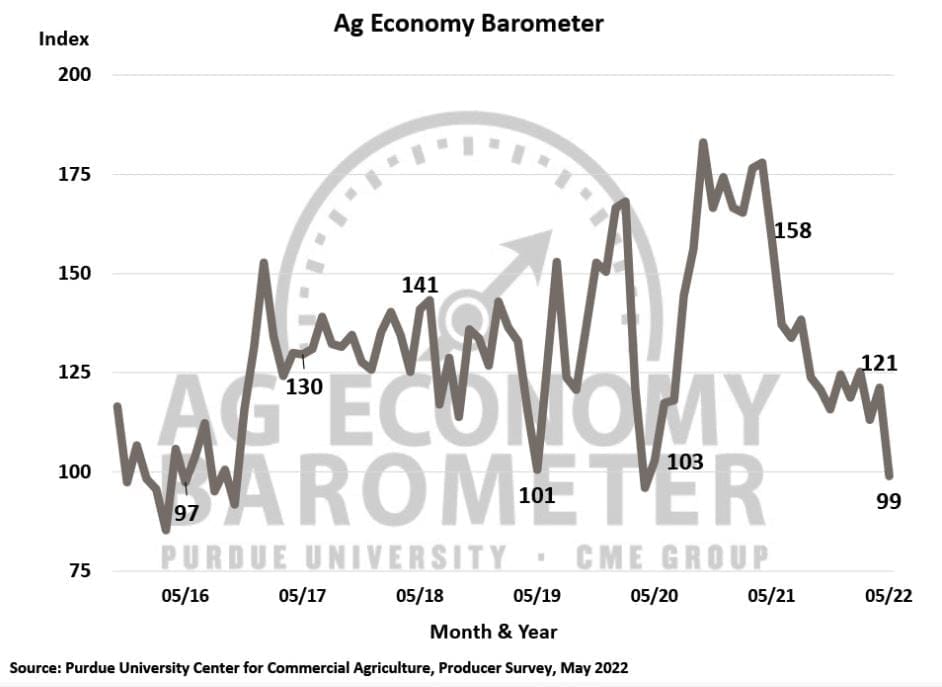

The latest Purdue University/CME Group Ag Economy Barometer dropped to its lowest level since April 2020, down 22 points from April to a reading of 99 in May. Agricultural producers' perceptions regarding current conditions on their farms, as well as their future expectations, both weakened in May.

The Index of Current Conditions fell 26 points to 94 and the Index of Future Expectations fell 21 points to a reading of 101.

The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers' responses to a telephone survey. This month's survey was conducted between May 16 and May 20.

Purdue researchers said despite strong commodity prices, May’s weakness in producers' sentiment appeared to be driven by rising production costs and uncertainty about where input prices are headed.

That combination is leaving producers very concerned about their farms' financial performance, researchers said.

The Farm Financial Performance Index declined 14 points to a reading of 81 in May. The percentage of producers who expect their farm's financial performance to worsen in 2022 compared to last year rose from 29% in April to 38% in May.

Over the course of the last 13 months, the Farm Financial Performance Index has fallen 41% below its life of survey high of 138 set in April 2021.

The Farm Capital Investment Index drifted to an all-time low in May and is down 30 points when compared to the same month last year. In the May survey, only 13% of respondents said this is a good time to make large investments in their operation, while 78% said they viewed it as a bad time to invest in things like machinery and buildings.

Higher input costs remain a top concern for producers with 44% of those surveyed choosing it as the biggest concern facing their farming operation in the coming year. Additionally, 57% of producers said they expect a 30% or more rise in prices paid for farm inputs in 2022 compared to prices paid last year.

The May survey also asked producers about their expectations for input costs in 2023 compared to 2022 with nearly 39% of producers indicating they expect an additional cost increase of 10% or more in the coming year.

In response to a Biden administration policy proposal for a $10/acre wheat/double-crop soybean crop insurance subsidy, this month's survey asked respondents if the subsidy would encourage them to plant more wheat in fall 2022 than would otherwise be the case. Among producers who have employed a wheat/double-crop soybean rotation in the past, 22% said it would encourage them to plant more wheat.