Projected improvements in financial performance may be behind the rise in the ag sector’s sentiment about the state of the industry.

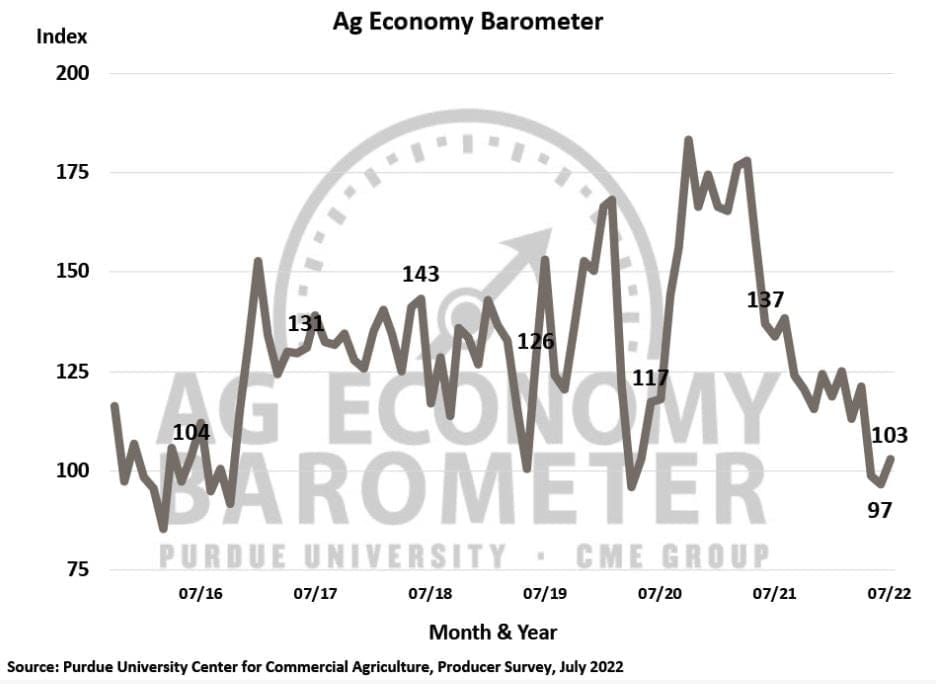

The Purdue University/CME Group Ag Economy Barometer farmer sentiment index rose 6 points in July to 103, up from 97 in June. Producers were somewhat more optimistic about both current and future economic conditions on their farms when compared to June, researchers said.

The Index of Current Conditions rose 10 points to 109, and the Index of Future Expectations rose 4 points to 100. Researchers said while all three indices rose in July month, all were still 23% to 24% lower when compared to the same time last year.

The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted between July 11 and July 15.

“Even though we saw a slight uptick in sentiment this month, there is still a tremendous amount of uncertainty in the agricultural economy,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Key commodity prices, including wheat, corn and soybeans, all weakened during the month and producers remain concerned over rising input prices and input availability.”

Farm operators in the July survey were concerned about several issues affecting operations, including higher input prices (42% of respondents), lower crop prices (19% of respondents), rising interest rates (17% of respondents) and availability of inputs (15% of respondents).

The Farm Financial Performance Index, which is primarily reflective of income expectations for the current year, improved 5 points to 88 in June. However, for July, 49% of respondents said they expect their farm to be worse off financially a year from now, which compares to 51% who felt that way in June.

Researchers said this is a markedly more pessimistic outlook than producers provided a year ago when just 30% of respondents said they expect their financial condition to worsen in the upcoming year.

Producers remain uncertain over their expectations for crop input prices over the next 12 months. In July, 18% of crop producers said they expect 2023’s crop input prices to decline between 1% and 10% when compared to 2022’s prices, versus 12% who felt that way in June.

Meanwhile, 26% of respondents in July said they expect 2023’s prices to rise by 10% or more, compared to 38% who expected a crop input prices to rise that much in June.

The Farm Capital Investment Index remains near its record low, up one point to 36 in July. Higher costs in machinery and new construction, as well as uncertainty about profitability and rising interest rates were among the reasons few farmers felt now was a bad time to make new purchases.